WorldGold Corp.

Summary

WorldGold Corp is an exploration and mining development company with a focus on global gold deposits. The company has acquired multiple high value gold concessions in Guinea, West Africa near several multi-million ounce mines.

Highlights

2 gold mines spanning 208.93 km2

5 gold mines under LOI

Near multi-million-ounce mines

Many projects are covered with Artisanal workings often extending over 500m along strike

Test work confirms high gold recoveries achievable with simple crush-grind-float regrind CIL circuit

Experienced board and management team

Disciplined capital management

Overview

Target Raise - $10,000,000

Minimum - $5,000

Investment Raised - $500,000

Previous rounds - N/A

Have a question about this project or need more information? You can ask the company leaders directly.

The Business

WorldGold focuses on acquiring, developing, and mining gold. Through key relationships and a strong management team, they have acquired 2 gold concessions with 5 additional under LOI in one of the most sought after areas of the world.

About Guinea

Guinea is a neighbor to top gold producers in African such as Ghana, Mali and Burkina Faso. Like its neighbors, Guinea lies on the gold-rich Birimian Greenstone Belt. Although the mining industry in Guinea is still developing, the country has great potential as a gold producer. This potential has been demonstrated by the recent gold discoveries of commercially viable gold deposits as a result of the increased gold exploration activities in the country. A perfect example of this is the discovery of the Siguiri gold mine, which is estimated to contain about 6.5 million ounces of gold.

Guinea Conakry is one of the richest countries in the world in the terms of natural gold reserves. “Gold is becoming an important commodity in Guinea as international exploration funding to the country is increasing significantly”

– KPMG, Guinea Country Mining Guide

The Market

Gold is the most popular investment instrument among banks and private investors due to its uses in industrial uses and prevalence in jewelry making. It’s a free element and in its native form can be found as nuggets, grains, or flakes. Its found in rocks, veins, and in alluvial deposits.

Primary Market Drivers - Gold is becoming highly sought after safe haven and hedge there are several economic and political uncertainties looming with no clear resolution. A few of the drivers are:

Newly dismal interest rate outlook.

Trade wars between the #1 and #2 global economies

China is going through a long-term growth problem and banks are loaded up on bad debt.

Simply people are buying lots of gold. Individual investors along with institutions and central banks.

Growth Projections

India, largest consumer of gold, is set to become the fastest- growing economy in coming decades (Forbes).

Adoption of Internet of Things (IOT) is leading explosion of electronics (and gold) used in consumer durable goods.

Gold Highlights

Central banks bought 22.4t of gold in Q2 2019.

Holdings of gold-backed ETF’s grew 67.2t in Q2.

Gold supply grew 6% in Q2 to 186.7t.

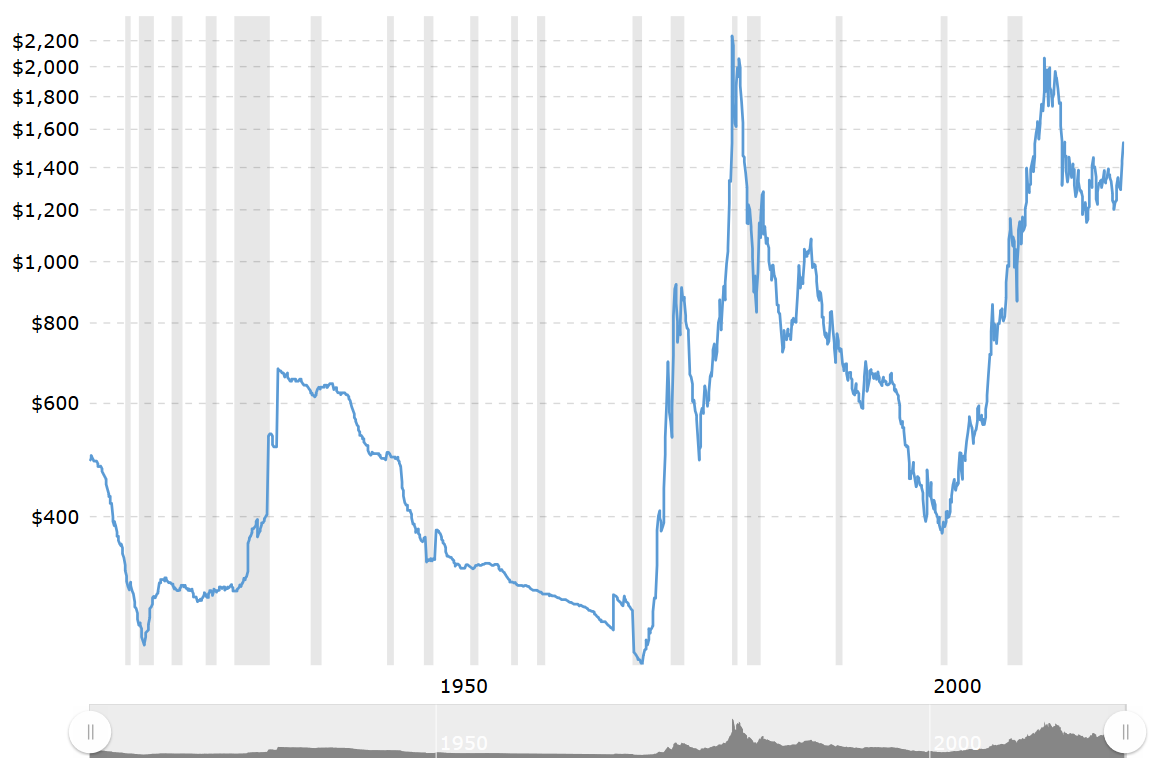

Gold prices shot to multi-year highs and broke through US $1,400/oz for first time since 2013.

The Board of Directors

Garrett Krause, Chariman and CEO

35+ years as an international investor, entrepreneur, venture banker and commodities trader. Mr. Krause helped grow an oil and gas company into one of Canada’s largest independent oil producers which listed on NYSE and was acquired by China National Petroleum for $4.17B.

Chris Langlois, Managing Director

Seasoned entrepreneur with heavy project management and business development experiences. Mr. Langlois excels in establishing and expanding operations to meet expanding markets. Chris led managed IT for banks with $10B+ in assets and has proven himself in private equity and deal making.

Dr. David Makongo, Dir. of Africa Operations

22 years experience in Africa mining, security of tenements, compliance with local laws, mine acquisitions, and strong ties to government and Ministry of Mines. Dr. Makongo has a long history of successful mine acquisitions, has secured 12 environmental permits, and 4 feasibility studies in different African countries.

Scott Sproull, Board Member

CEO of the Pacific Institute, Mr. Sproull aids organizations in unlocking potential through strategic branding and cultivating leadership teams and cultures. Over the past 45+ years, the Pacific Institute has worked in private, government, and nonprofit sectors in over 60 countries, including 50% of the Fortune 1,000, with over 6.5M participants

The Africa Management Team

Dr. David Makong, Dir. of Africa Operations

See bio above.

Sereko Camara, Director General

Holds an Engineering Degree in Mining Processing and Metallurgy, with 10+ years experience in the facilitation and management of mining projects.

Stone Bassey, Program Manager

Has successfully been leading field and operations management in Kindia and Kankan. Mr. Stone has been working on Mount Dokou coordinating efforts in Africa

Conte Sekou, Chief Geologist

Mr. Sekou oversees mining and geology activities including prospecting, drilling, and structural and general geology. He aids in the creation of budgets, costs, and models the data.

The Future of the Business

WorldGold is raising capital to finalize its drilling program to validate the vast quantities and qualities of its gold resources, starting with its Hopewell project. Upon the completion of the drilling programs and the granting of its operating permits, WorldGold is targeting between 30,646 and 51,076 ounces of mined gold with high margins based on a cash operating cost of $646/oz and an all in sustaining cost (AISC) of $868/oz. This could result in over $61,000,000 in revenue during the first year of mining of just one of its 7 gold deposits. While mining has commenced at Hopewell, the company will advance drilling programs in its other deposits to prepare them for mining operations.